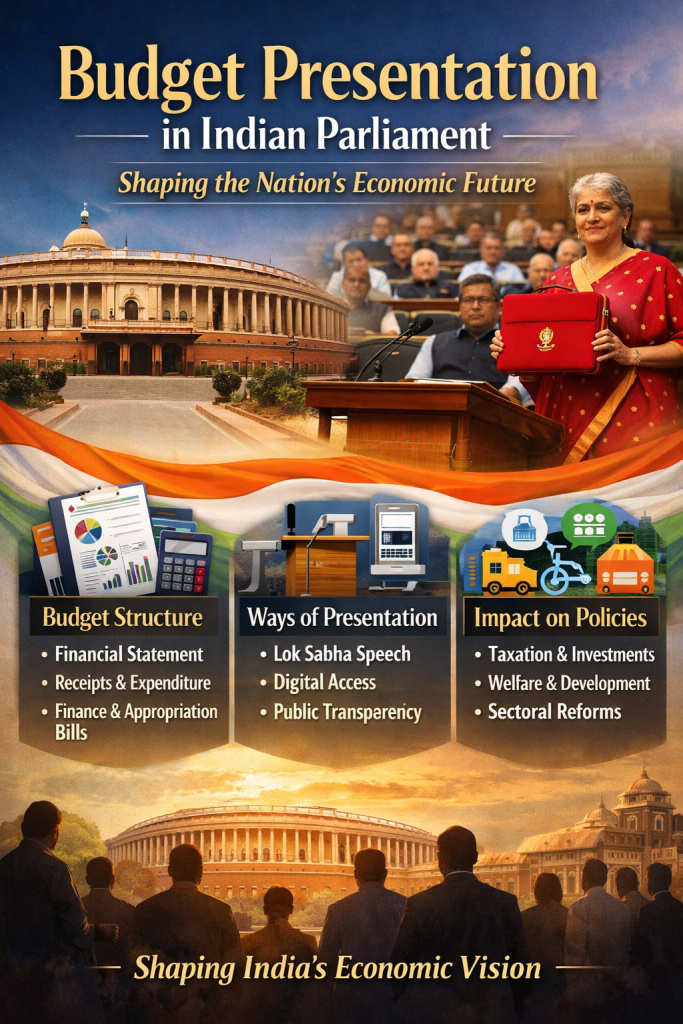

The Budget is more than just numbers on paper; it is the financial blueprint of India’s ambitions, priorities, and policies. Every year, the Finance Minister presents the Union Budget in Parliament, outlining the government’s estimated revenues, expenditures, and key policy directions for the coming fiscal year.

Structure of the Budget

The Union Budget follows a structured format:

- Annual Financial Statement – The main statement showcasing projected revenues and expenditures.

- Receipts and Expenditure Details – Divided into Revenue and Capital sections for both the Union and States.

- Finance Bill & Appropriation Bill – Legal instruments to approve taxes and allocate funds for government schemes.

Ways of Presentation

The Budget is traditionally presented in the Lok Sabha, often in a speech that highlights the government’s economic strategy, reforms, and welfare measures. Over time, it has evolved with digital innovations, making detailed documents accessible to the public for transparency and scrutiny.

Impact on Policies

The Union Budget is not just about numbers; it is a roadmap for governance. It influences taxation, subsidies, infrastructure investments, and social welfare programs. Policies related to education, health, industry, and agriculture are all shaped by the allocations and priorities reflected in the Budget. Businesses, investors, and citizens alike adjust their strategies and expectations based on the direction signaled by the Budget.

In essence, the Budget presentation is a reflection of India’s economic vision—a blend of fiscal discipline, social welfare, and growth-oriented policy-making that impacts every citizen and shapes the country’s future.

Leave a comment