In the world of finance, few stories are as captivating as the rise and fall of Lehman Brothers. From its humble beginnings as a small cotton trading firm in Montgomery, Alabama, to its ascension as one of Wall Street’s most respected investment banks, Lehman Brothers’ journey is a testament to ambition, innovation, and the unpredictable nature of the financial world.

Founded in 1850 by three brothers, Henry, Emanuel, and Mayer Lehman, the company started as a modest cotton brokerage business. Over the years, Lehman Brothers expanded its operations into commodity trading and brokerage services, building a reputation for shrewd business acumen and strategic partnerships. By the early 20th century, the firm had established itself as a major player in the financial industry.

In the latter half of the 20th century, Lehman Brothers experienced unprecedented growth, becoming a leading investment bank on Wall Street. The firm’s success was fueled by its innovative approach to finance, including its early involvement in the mortgage-backed securities market. By the 1980s and 1990s, Lehman Brothers had solidified its position as a Wall Street giant.

However, Lehman Brothers’ success was not without controversy. The firm’s aggressive expansion into the subprime mortgage market ultimately proved to be its downfall. As the housing market began to decline in 2007, the value of Lehman Brothers’ mortgage-backed securities plummeted, leaving the firm with billions of dollars in losses.

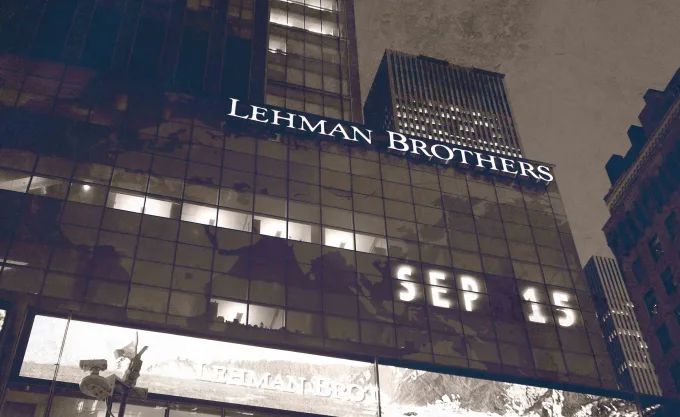

On September 15, 2008, Lehman Brothers filed for bankruptcy, sending shockwaves through the global financial system. The collapse of the firm triggered a credit crunch, leading to a severe economic downturn and widespread job losses. The bankruptcy filing was the largest in US history, with Lehman Brothers citing $613 billion in debts.

The collapse of Lehman Brothers led to a significant overhaul of financial regulations, including the passage of the Dodd-Frank Act in 2010. The act aimed to prevent similar financial crises by increasing transparency and accountability in the financial system.

Key Takeaways

- Risk Management: Lehman Brothers’ failure highlights the importance of effective risk management in finance.

- Regulatory Oversight: The collapse underscores the need for robust regulatory frameworks to prevent excessive risk-taking.

- Financial Stability: The firm’s bankruptcy demonstrates the interconnectedness of the global financial system and the potential for systemic risk.

The story of Lehman Brothers serves as a cautionary tale about the dangers of unchecked ambition and the importance of prudent financial management. As the financial industry continues to evolve, the lessons learned from Lehman Brothers’ collapse remain relevant, shaping the course of financial regulation and risk management.

Leave a comment